![]()

|

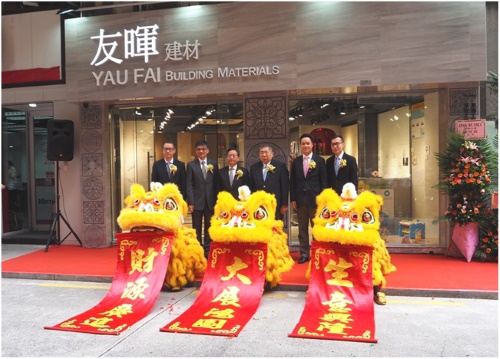

Starting from the left they are Mr. Zhang Youyun (Executive Director), Mr. Wang Shiguang (Chairman and Executive Director), Mr. Yue Jingxing (Chief Executive Officer and Executive Director), Mr. Leung Ka Lok (Chief Financial Officer and Company Secretary) and representative of Sole Sponsor, Joint Bookrunners and Joint Lead Managers, Mr. Michael Ngai, Associate Director of China Galaxy International Securities (Hong Kong) Co. Limited. |

|

- Global Offering of 200,000,000 shares

- Offer price ranges from HK$0.90 to HK$1.00 per share

HONG KONG, May 29, 2017 - (ACN Newswire) - Risecomm Group Holdings Limited ("Risecomm" or the "Group", proposed 1679.HK), the third largest PLC technology company in China, today announced details of its proposed listing on the Main Board of The Stock Exchange of Hong Kong Limited ("HKSE").

- Investment Highlights -

- Possesses core competency in power line communications (PLC) IC design and superior research and development ("R&D") capabilities in PLC technology, strives to maintain excellence in R&D of PLC technology

- One of the largest PLC IC suppliers in China, well positioned to benefit from the high barriers of entry and continuing growth and upgrading of the PLC industry

- Long-term cooperative relationship with State Grid Corporation of China ("SGCC") enables capture of huge opportunities in the PLC market

- One of the first-movers in the smart energy management industry with a number of energy management pilot projects launched in China

- Seasoned management and sales teams with distinguished technological expertise and sales and marketing experience

- Offering Details -

Risecomm Group Holdings Limited plans to offer a total of 200,000,000 shares under the Global Offering (subject to the Over-allotment Option), of which 180,000,000 will be for International Offering (subject to adjustment and Over-allotment Option) and 20,000,000 will be for the Hong Kong Public Offering (subject to adjustment). Assuming an Offer Price of HK$0.95 per share, being the mid-point of the indicative Offer Price range of HK$0.90 to HK$1.00 per share, net proceeds from the Global Offering, after deducting underwriting fees and estimated expenses payable by the Group in connection with Global Offering, are estimated to be approximately HK$144.1 million before exercise of any Over-allotment Option.

The Hong Kong Public Offering commenced at 9:00 a.m. on 29 May 2017 (Monday) and will end at 12:00 noon on 2 June 2017 (Friday). The final Offer Price and allotment results will be announced on 8 June 2017 (Thursday). Dealing of the shares is expected to commence on the Main Board of HKSE at 9:00am on 9 June 2017 (Friday) under the stock code 1679. The shares will be traded in board lots size of 2,500 shares each.

China Galaxy International Securities (Hong Kong) Co., Limited is the Sole Sponsor, and China Galaxy International Securities (Hong Kong) Co., Limited and Long Asia Securities Limited are the Joint Bookrunners and Joint Lead Managers of the listing.

- Investment Highlights -

Risecomm possesses core competency in PLC IC design and superior R&D capabilities

Since its inception in 2006, as a fabless PLC technology company, the Group has been focusing on PLC IC design and R&D of PLC technology. Its core competency lies in designing advanced application-specific ICs, or ASICs, and these proprietary ASICs are embedded in all its PLC products. The Group pioneered in developing PLC ICs with proprietary IC designs and advanced PLC technologies for deployment of automated meter reading (AMR) systems by SGCC. Also, the Group has been invited by SGCC to participate in the formulation and setting PLC industry standards in China since 2012.

The Group has been investing substantial resources in R&D and its R&D expenses are equivalent to on average about 9% of its total revenue. It has a 140-strong R&D team, or 34.5% of its entire workforce, and members of team have on average seven years of experience in related industries, approximately 12.1% of them hold a master's degree or higher (including PhD degrees) in related areas (such as communications technologies and electronic automation). Thanks to its R&D efforts, the Group now owns a significant intellectual property portfolio comprising 24 registered patents, 43 registered computer software copyrights, seven registered software products and seven registered IC layout designs as of the latest practicable date.

One of the largest PLC IC suppliers in China

The Group ranked third in 2016 among PLC IC suppliers in China in terms of sales volume of PLC products with an overall market share of 11.2% . It also captured 10.9% of SGCC's total bidding volume for PLC-based AMR devices. The PLC industry in China has high entry barriers as it is technology intensive and requires substantial practical experience for a player to able to meet the needs of the highly complex power grid infrastructure and operating environment. Although AMR application remains the dominant focus of the PLC industry in China, the industry is expected to continue to grow driven by government policies in support of the rollout of smart grids and upgrades of AMR systems, and also advancement in PLC technology. With its well established market position, technological advantages, R&D capabilities and long-term business relationship with SGCC, the Group is well positioned to solidify its position in China's PLC market.

Long-term stable cooperative relationship with SGCC

In 2008, Risecomm was selected by SGCC to participate in its first AMR pilot project in China undertaken in Heilongjiang Province. In 2010, the Group's AMR products started to be commercially deployed in SGCC's AMR systems. In 2012, the Group was invited by SGCC to participate in the formulation and setting of PLC industry standards in China. In 2014, the Group's OFDM ICs (second-generation PLC ICs of the Group) was first used in SGCC's AMR pilot project. In 2015, the Group became a qualified PLC technology company for Southern Grid, which qualified it for direct bidding of the latter's concentrator and collector contracts. In 2016, Risecomm began to take part in SGCC's pilot projects for the "Four-Meters-in-One" initiative and broadband PLC respectively. As at 31 December 2016, the Group's AMR products were commercially deployed by SGCC in 23 of the 26 provinces it covers in China. For years, the Group has worked closely and maintained a long-term relationship with SGCC, which has enabled it to seize the huge business opportunities in the PLC market.

One of the first-movers in the smart energy management industry

Risecomm's smart energy management business covers applications of streetlight control, building energy management and photovoltaic power management. Leveraging first-mover advantage and strong capabilities in PLC technologies and product development, the Group has become the largest PLC solutions provider in China for the streetlight control application, with a market share of 48.1% . As at 31 December 2016, the Group's PLC technology and solutions were sold to streetlight control clients in 15 provinces of China. In recent years, the Group has expanded the application scope of its PLC products and solutions to other selected strategic areas of smart energy management. In particular, the Group has developed PLC products and solutions for building energy management applications for enterprise users, such as Shenzhen Fox-Energy Technology Co., Ltd, a subsidiary of Foxconn Technology Group, as well as certain hotel chains and tertiary institutions in China. And, in 2011, it started to sell PLC products in connection with photovoltaic power management for solar micro-inverters to Zhejiang APsystems Technology Co., Ltd., a leading micro-inverter producer in China.

Seasoned management and sales teams

Risecomm's management team includes technology experts who bring a wealth of experience in IC design and communications technology as well as the PRC power sector. The Group's R&D and overall business strategies are led by Mr. Yue Jingxing, its co-founder, executive Director and Chief Executive Officer, who has more than 20 years of experience in IC design. As for R&D with regard to technology advancement and applications, it is led by Dr. Gu Jian, the Group's co-founder and chief technology officer and vice president of Risecomm WFOE, who has more than 20 years of experience in the communications technology industry. Both of them obtained postgraduate degrees in electrical engineering in the United States and have extensive work experience in prominent US communications technology companies prior to founding the Group. In addition, the team includes Mr. Wang Shiguang, the Group's Chairman and executive Director, who has more than 15 years of management and sales experience in the electronics and power sectors in China. Mr. Wang has played a critical leading role in expanding the sales and marketing reach of the Group's AMR business in connection with AMR deployment in SGCC's smart grids. The distinguished technological expertise and sales experience of Risecomm's teams will continue to power the Group's expansion and business growth.

-- Future Strategies --

Further strengthen Group's capabilities in PLC technology and R&D

The Group will continue to focus on R&D and strengthen its core capabilities in PLC technologies. In particular, it plans to boost its R&D capabilities through working with or acquiring intellectual property rights from third parties, moves that can supplement and allow it to expedite R&D in such areas as broadband OFDM ICs, "PLC+RF" dual-mode technology, and unified control systems for smart energy management. At the same time, the Group will continue to work closely with key industry participants (such as SGCC) and be involved in greater extent in drafting and formulation of industry standards (such as those for broadband PLC). Furthermore, it will also utilize its existing expertise and further explore in the research directions in support of the "Four-Meters-in-One" initiative led by SGCC.

Expand AMR business to new geographic markets and further enhance the functionality and competitiveness of AMR products

According to a Frost & Sullivan survey, Southern Grid started commercial deployment of AMR systems in March 2016, with a purchase plan of 75 million smart meters for the five years between 2016 and 2020. In 2015, the Group became a qualified PLC technology company for Southern Grid and, in August 2016, it engaged a sales agent to help promote AMR sales in the Southern Grid market. In addition, it will continue to put more resources to expand its market share in SGCC biddings, enhancing the functions of its AMR products and continue to develop innovative and competitive AMR products with new PLC technologies. Moreover, additional resources will also be devoted to enrich AMR product offerings and expand the Group's AMR product assembly capacity. To these ends, Risecomm has established a new product assembly hub in Changsha, Hunan Province mainly for mass production of collector and smart energy management products and solutions.

Enhance capabilities in product development and sales and marketing to accelerate the growth of smart energy management business

With the government rolling out more polices and industries initiatives in support of energy conservation and environmental protection (especially those in the 13th Five-Year Plan of National Economy and Social Development), the Group plans to further invest in smart energy management to speed up revenue growth of the business. It intends to enhance product development efforts to provide an enriched pipeline of products and solutions that address the needs of each of strategically selected areas of smart energy management applications, including streetlight control, building energy management and photovoltaic power management applications. Moreover, it plans to strengthen sales and marketing efforts in order to expand customer base for each of these strategically selected smart energy management applications. It will also enhance direct sales and also establish strong sales channels through system integrators, energy management companies and energy project contractors.

Going forward, the Group will continue to expand and strengthen its R&D team by recruiting talent and providing comprehensive training to R&D personnel. It will also constantly improve the functions of its AMR products and expand the business to new geographic markets. With extensive industry experience, proven track record and an experienced management team, the Group will continue to make progress with its business and its hope is to bring satisfactory returns to investors.

Financial Highlights

(RMB'000) For the year ended 31 December

2014 2015 2016 CAGR

Revenue 232,628 340,724 390,210 29.51%

Gross profit 114,822 175,753 195,263 30.41%

Gross profit margin % 49.4% 51.6% 50.0% N/A

Profit for the year 40,555 57,603 19.18%

Use of Proceeds

Assuming an Offer Price of HK$0.95 per share (being the mid-point of the indicative Offer Price range), the estimated net proceeds of the global offering is HK$144.1 million intended for the following uses:

- Research and development of the PLC technology and related products and solutions / 60.0%

-- Investing in development of intellectual properties

-- Possible mergers and acquisitions of technology and/or research companies with complementary core technologies and intellectual properties, or to acquire technologies or intellectual property rights from those companies

-- Recruitment of R&D staff to support the business and core research activities, as well as day-to-day R&D functions

- Sales and marketing expenditure / 20.0%

-- Cultivating relationships with any possible sales channels and conducting training for any external sales and marketing force

-- Participating in trade exhibitions and industry forums at home and abroad

-- Conducting marketing and promotion activities to enhance brand recognition

-- Participating in more pilot projects for smart energy management business

-- Recruiting sales and marketing personnel

- Repayment of an entrusted bank loan obtained for purchase of a new product assembly hub in Changsha, Hunan Province / 10.0%

- Working capital and general corporate purposes / 10.0%

About Risecomm Group Holdings Limited

Founded in 2006, Risecomm Group Holdings Limited is a power line communications (PLC) technology company specializing in the design,development and sale of system-on-chip ICs, modules, devices and solutions adopting the PLC technology. As one of China's largest PLC technology companies, the Group's core competence is the development of application-specific integrated circuits (ASICs) and its proprietary ASICs are embedded in all of its PLC products. With the support of a strong R&D team and abundant resources, the Group continues to pursue technological innovation. The Group's PLC products are used mainly by the power grid companies in China. It is one of the first PLC technology companies to have AMR products commercially deployed in State Grid's AMR systems. In 2016, the Group's AMR products were commercially deployed by the State Grid in 23 of the 26 provinces in China that the grid covers. At the same time, the Group is the largest PLC solutions provider for streetlight control in China, and also provides various PLC products and solutions for a number of applications related to energy saving and environmental protection. For more details about Risecomm, please visit website: http://www.risecomm.com.cn/en/.

Media Enquiries:

Strategic Financial Relations Limited

Heidi So, +852 2864 4826, heidi.so@sprg.com.hk

Cecilia Shum, +852 2864 4890, cecilia.shum@sprg.com.hk

Sophie Du, +852 2114 4901, sophie.du@sprg.com.hk

www.sprg.com.hk

Copyright 2017 ACN Newswire. All rights reserved. www.acnnewswire.com